Home inspectors document issues or defects within a property and report on the condition of the house. Most home inspections are performed at the time of sale. However, insurance companies often require the four main systems of a home to be inspected before writing a policy, especially for an older property. If you own a home, here are a few things to expect when scheduling a 4-point home inspection.

Why Order a 4-Point Home Inspection?

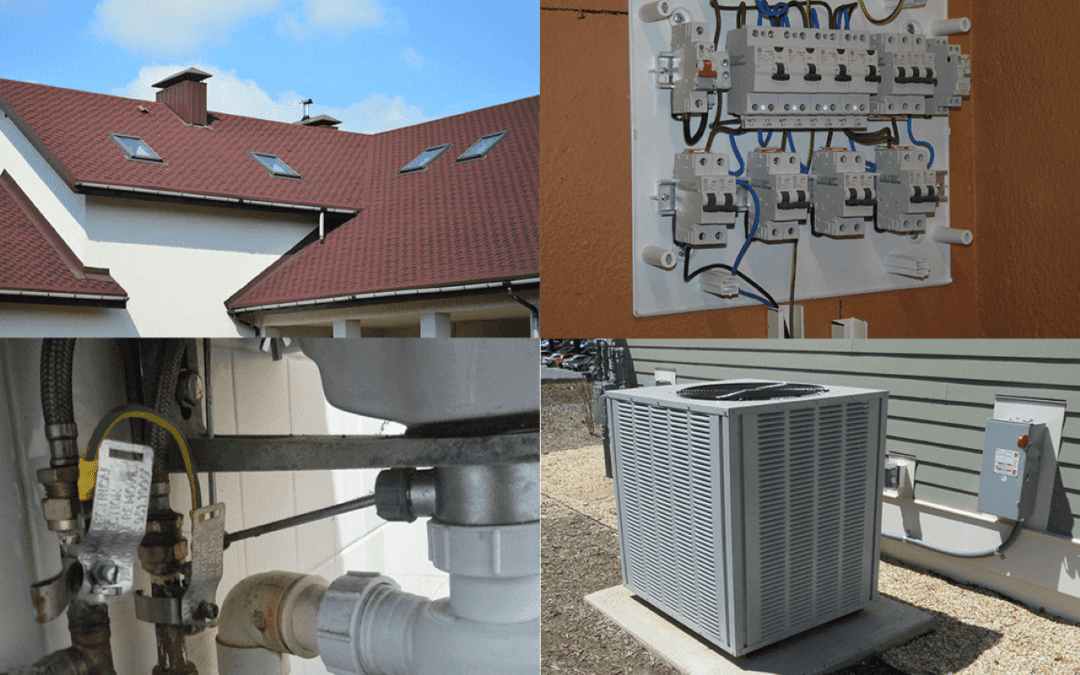

A 4-point home inspection assesses the main components of the property. The inspector will examine the roof, electrical, plumbing, and HVAC system. This type of inspection is often required by insurance underwriters before they decide to provide coverage for the home. Older homes often need more repairs or work performed in the coming years. Some insurance companies request a 4-point inspection of any property that is more than 40 years old, though requirements will differ depending on your insurance provider. The inspection helps insurance providers to determine the level of risk involved.

Not the Same as a Full Inspection

Insurance companies don’t need a full inspection when they’re deciding to insure a customer’s home. The condition of the flooring and functionality of the appliances may be of concern to the homeowner but won’t affect the property’s insurability.

The insurance company wants to determine the risk they are assuming by insuring a property. A 4-point inspection includes the main systems of the home. The inspector will examine components that are expensive to replace or that could cause major damage in case of a malfunction. Some properties may not be covered if there’s no central air conditioning or a functioning HVAC unit in the building.

Components that are examined on the electrical system include the panel, wiring, and circuits. The plumbing system will be checked to determine the condition of the pipes and the material used. Plumbing systems with polybutylene pipes are at a greater risk of bursting, which can lead to significant damage from flooding. If an insurance company agrees to offer coverage on a house with polybutylene pipes, they will likely not cover flooding. The inspector will look at the HVAC system and the roofing and determine the age and life expectancy of each. Homes that are more than 40 years old are less likely to be covered because the materials are older and prone to failure.

Ordering a 4-Point Inspection

When conducting a 4-point home inspection, insurance agencies expect the inspector to take photos of the features and materials installed and detail any concerns in the inspection report.

If you need to schedule a 4-point inspection, ask your insurance agent for a list of recommended inspectors to use. If you’re switching insurance companies, ask if a previously conducted 4-point inspection can be used again. Some insurance companies will accept a 4-point inspection that is less than 3 years old.

Understanding the basics of 4-point home inspections allows you to know what to expect for your home. The inspection will allow a homebuyer to secure homeowners insurance before closing on the property.

Northern Florida Home Inspections offers 4-point inspections and other home inspection services. Contact us to request an appointment.